Construction support offshore vessel (CSOV) market update

In our last article from Q1/2022 (Season Outlook - CSOV) we provided an outlook for the 2022 summer season concentrating on Walk to Work Vessels (W2W) and Constructive Support Offshore Vessels (CSOV) availability in Europe. The signals at the time indicated a heated or potentially even undersupplied market. Now that the main working season is slowly coming to an end, it is time to reflect, evaluate and start thinking about 2023.

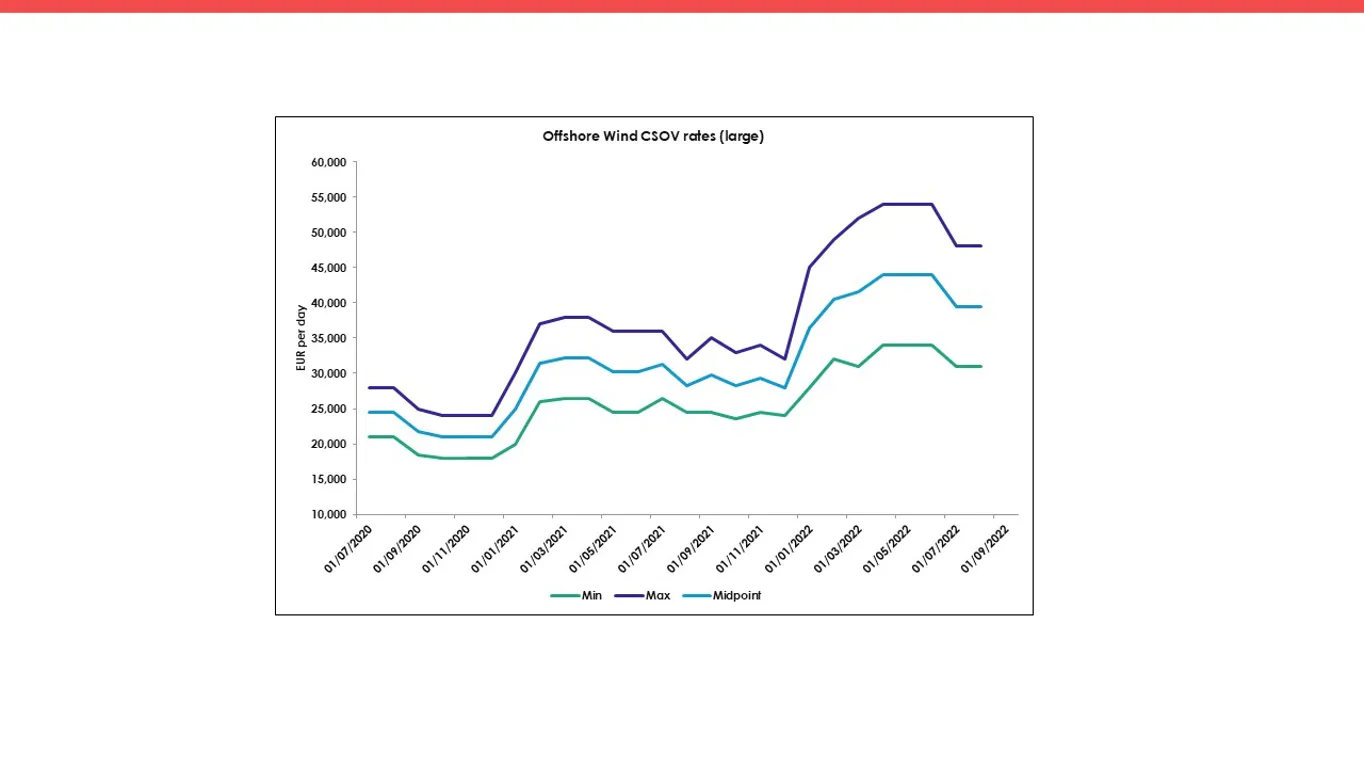

As predicted, we have seen a steep incline in day rates for “traditional” subsea tonnage as displayed below, along with a moderate increase in the purpose built CSOV class.

Dayrates for short-term contracts in the subsea and CSOV market, defined as contracts with a duration of less than two years, have steadily increased since 2016 as the market has gradually tightened, apart from a 2020 Covid-19 halt. As the current fleet is predominantly made up of subsea Inspection, Maintenance and Repair (IMR) vessels, we find a clear correlation between CSOV rates and general subsea rates.

We did see emergent requirements from charterers in the summer months and these were hit with higher-than-expected rate levels, but this can only be expected when its unplanned and the vessels available have multiple options to choose from. Nevertheless 2022 was mostly a balanced supply and demand season in the Walk to Work vessel segment.

However, it is worth noting that five requirements for CSOVs were withdrawn from the market between March and May 2022 creating a buffer to smooth out the vessel demand supply situation.

In the past months we have seen another strong indicator for a tighter market in the longer term – charters for subsea tonnage.

Reach chartered Deep Cygnus for 4 years from early 2023, Grand Canyon 2&3 have been extended for 5 years with Helix, Subsea Viking will have 3 years with Van Oord from Q1/2023, just to name some examples.

Tonnage of this calibre has been widely used for larger Walk to Work campaigns in offshore wind until a few months ago and will not be available for such scopes in the medium term, or only at prices that most offshore wind clients will not be able to pay.

Looking ahead to 2030

The expected amount of CSOVs required until 2030 based on the current projected offshore windfarms is high. Some may argue that not all these offshore projects will be built in the timeframe currently assumed, however there is mounting pressure to bring additional offshore windfarm capacity online sooner, given the geopolitical influences.

The supply-demand gap remains noticeable based on known projects and projections. The gap between has traditionally been filled with subsea tonnage (Tier 3) with a rental gangway system.

Most charterers in offshore wind would, if they had the choice, prefer to charter purpose-built tonnage (Tier 1) for obvious reasons such as fuel efficiency, high accommodation standard and good workflow. Should that not be available, you would usually look at converted vessels with permanently installed gangway (Tier 2) and only then at Construction Support Vessel (CSV) with a rental gangway system (Tier 3).

With almost no order book for newbuilt subsea tonnage and increasing demand from the oil and gas sector for these vessels, it will be harder and harder for offshore wind clients to satisfy their demand that exceeds the Tier 1 and Tier 2 availability. Growing CSOV demand for the years to come in offshore wind in combination with a reduced supply side will very likely drive CSOV rates up further, especially for summer season work. Such an increase is backed with good arguments by suppliers around significant fuel savings and no additional cost for rental equipment in comparison to the Tier 3 vessels.

While we see that the oil and gas market appear to be aware and alert about this situation, it seems offshore wind clients will only really get to feel how the market has turned when starting to tender for their 2023 offshore project demands. So far, we have noticed very limited tender activity for 2023 in wind, whereas oil and gas charterers have secured long term vessel capacity and are already enquiring for subsea/Walk to Work vessels for the 2023 summer season.

To date hardly any offshore wind client has been left without a vessel when in need of Walk to Work capacity, no matter of how late they went to the market with their requirements. Although it is not a given that this will be the case next year, we expect it to be a realistic scenario that less attractive campaigns may struggle to find affordable tonnage in some cases.

Get in touch with our C/SOV Offshore Shipbroker Tim Börner for more insight on the offshore vessel market availability.

*Image credit: Ampelmann